Collaborations between researchers and revenue officials can guide bold reforms with big impacts, boosting domestic revenue mobilisation to finance the Sustainable Development Goals.

Many low- and middle-income countries (LMICs) are rich in resources, but wealth generated is concentrated among a small number of individuals – high-net-worth individuals (HNWIs) have financial assets over US$1 million. In Africa, 166,760 HNWIs were worth US$1.6 trillion in 2018. Tax revenues make up over a third of GDP in OECD countries, but less than a fifth in Sub-Saharan Africa.

The International Centre for Tax and Development (ICTD) at the Institute for Development Studies (IDS), co-funded by DFID, conducts research on making tax policies more conducive to pro-poor economic growth and good governance. This research has informed high-impact reform measures, which have improved domestic revenue mobilisation (DRM)

Reaping a tax harvest in Uganda

In 2015, the Uganda Revenue Authority (URA) approached the ICTD to conduct research on how to better tax HNWIs. The study’s findings on tax evasion by HNWIs led the URA to set up a dedicated HNWI unit. In three years, the filing of tax returns by HNWIs increased from 13% to 78%. Consequently, the URA collected an extra £14.7 million in revenue.

Learning lessons across Africa

This success became widely recognised and the URA and ICTD were approached by other tax revenue authorities for advice.

- The URA and ICTD shared knowledge with revenue authorities in Ethiopia, Ghana, and Kenya, and with the East African Revenue Authorities’ Technical Committee.

- Work with the Rwanda Revenue Authority raised £7 million in 2016 by improving voluntary tax compliance through more effective communication with taxpayers.

The principles of engagement for collaborative research between academics and government agencies developed by the URA and ICTD were endorsed by the United Nations University World Institute for Development Economics Research (UNU-WIDER) and adopted by the African Tax Administration Forum and the African Tax Research Network.

Taxing local, thinking global

The ICTD followed its locally-grounded research with advocacy to embed it into policy at the highest level.

- The UK supported the set-up of the Addis Tax Initiative (ATI) supporting LMICs to strengthen tax systems, drawing on ICTD research in Africa.

- The ICTD advises multilateral organisations and development agencies, including DFID and the World Bank’s Global Tax Team, and consults with major civil society organisations.

Domestic revenue – collecting more, collecting better

DRM is crucial to achieving the SDGs. A 2% increase in LMICs could add US$144 billion to their budgets, equivalent to the value of overseas development aid annually.

However, taxation policies can affect citizens differently. Research from ICTD and others (Oxfam, ActionAid) has demonstrated that targeting the informal economy (where women make up a disproportionate percentage of workers) and providing tax holidays for influential corporations (mostly employing men) is inequitable. The sensitisation of governments to the equity aspects of taxation could help ensure that collecting increased revenue does not deepen poverty and inequality.

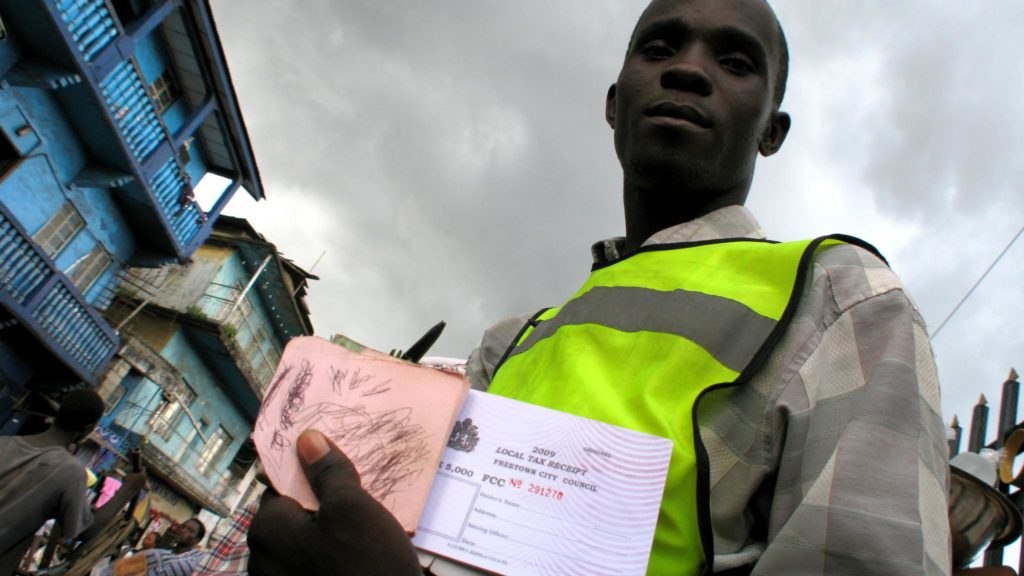

Property taxes, an equitable source of funding for local public services, are underutilised by LMIC governments. The African Property Tax Initiative (run by the ICTD and DFID co-funded DFID), is working in 10 African countries to improve tax policies and implementation.